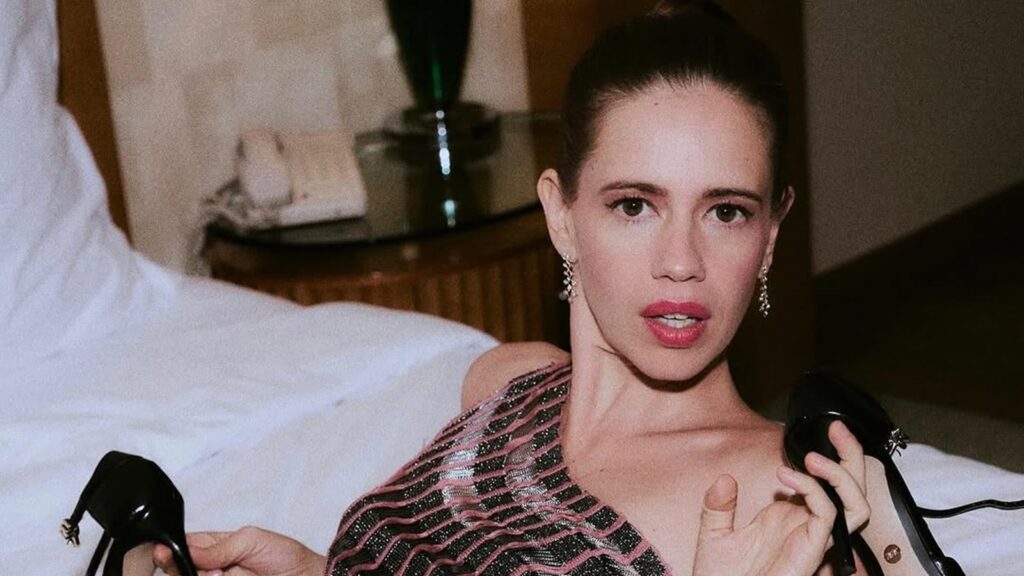

On a current episode of the Aleena Dissects podcast, Kalki Koechlin provided a refreshing tackle life-style decisions and what actually defines wealth. She shared how some individuals venture luxurious — arriving in an Audi with a driver, however reside in cramped one-bedroom houses. “That’s a selection,” she stated, declaring how societal perceptions of success are sometimes primarily based on appearances.

Kalki revealed her personal priorities lie elsewhere. Quite than flashy autos, she invests in a gorgeous house in Goa and ceaselessly travels to get pleasure from high quality time together with her daughter. “My kharcha goes into that,” she stated. For her, the actual luxurious is freedom, seaside weekends, a satisfying house life, and moments that matter over materials showmanship.

Regardless of coming from wealth and privilege, Koechlin’s selection to remain grounded and humble is a mark of maturity. These experiences construct resilience, self-reliance, and problem-solving expertise. In keeping with Sonal Khangarot, licensed rehabilitation counsellor and psychotherapist, The Reply Room, additionally they foster empathy, scale back entitlement, and put together kids to face real-life challenges with confidence.

Story continues under this advert

No matter gender, wealth, or background, everybody ought to be taught life expertise, as they educate humility, encourage equality, and form a grounded, emotionally clever grownup who respects all types of work and walks of life.

Coming to why she selected a grounded life-style in comparison with a flashy one, she stated that it’d really feel tempting to present in to that impulse buy, particularly in case your present social circle belongs to a life-style you battle to maintain up with. That’s the place monetary self-discipline and schooling step in, stopping you from earning profits errors that may price you and your pockets in the long term.

Monetary self-discipline is the flexibility to make sound monetary selections and keep inside budgets, avoiding impulsive spending, in order that one is steadily shifting towards set objectives. “Training monetary self-discipline just isn’t developing with methods to economize however creating sure habits that consolidate one’s place by way of finance, improve it, or hold that individual safe,” he stated.

Rayan Malhotra, CEO, Neofinity, instructed these 5 easy hacks to get your monetary priorities so as:

Story continues under this advert

1. Solely purchase it if you should buy it twice: Should you can afford it as soon as, you’re surviving it. Should you can afford it twice, you’re selecting it. This isn’t about being frugal—it’s about creating margin. A niche between impulse and intention. An area the place actual selection lives.

2. Outline your ‘Sufficient Quantity’: Revisit it each quarter. How a lot is actually sufficient to reside effectively in the present day? Not in your imaginary future self on a yacht. For you—now. Development with out grounding turns into greed. This quantity isn’t a aim. It’s an anchor.

3. The 24-Hour Need Rule: Need one thing? Sleep on it. Nonetheless need it tomorrow? Go forward. Forgot about it? It was simply noise in your feed. This rule protects your focus as a lot as your pockets.

4. Month-to-month Emotional Budgeting: Not “The place did my cash go?” Ask: “How did it make me really feel?” Observe transactions not simply by quantity, however by emotional price. Remorse is pricey. Alignment is wealthy.

Story continues under this advert

5. Time is the actual forex: Spend accordingly. Each swipe, faucet, or order converts it into hours of your life. How lengthy did you’re employed for this? Is it value that? You don’t spend rupees. You spend time.