Receiving your first paycheck is a particular milestone in everybody’s life. It marks the start of your journey as an impartial grownup, able to taking up the tasks of the skin world. You might be lastly in a position to pay for issues your self and deal with your funds.

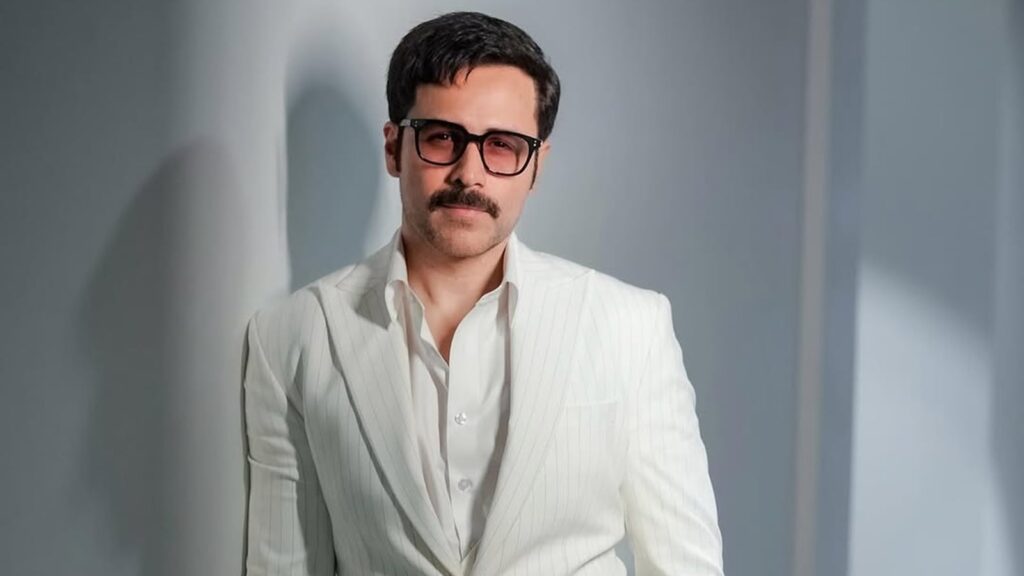

Emraan Hashmi just lately shared his first ‘huge’ paycheck story, recalling the way it kick-started his journey within the Hindi movie trade. In dialog with podcaster Ranveer Allahabadia, the Raaz actor shared: “I bought 25 lakhs and that was my fourth movie. I did that movie as a result of I needed to purchase my Honda Accord. I purchased it, after which banged the automotive the primary time I sat in it. I went to select up my then girlfriend, now spouse.”

“I consider the primary time you scratch a automotive, you then begin having fun with it,” he jokingly informed the host.

Story continues under this advert

In accordance with Mukesh Pandey, Director of Rupyaa Paisa, the urge to spend your paycheck is difficult to withstand; nonetheless, establishing some wholesome monetary behaviours early can stop disagreeable monetary habits down the highway.

Pandey outlined monetary self-discipline as the flexibility to make sound monetary selections and keep inside budgets, thereby avoiding impulsive spending and steadily transferring towards set targets. “Working towards monetary self-discipline will not be arising with methods to economize however creating sure habits that consolidate one’s place by way of finance, enhance it, or maintain that particular person safe,” he stated.

Listed here are 3 issues you need to do after receiving your first paycheck to ascertain new monetary tasks.

1. Create a Price range:

Step one to managing cash is understanding the place it goes. Write down your mounted bills (lease, transport, EMIs) and variable bills (purchasing and leisure). Setting spending limits means that you can management the quantity you spend whereas being conscious of your complete contribution for the month. Following a price range is basically your roadmap to making sure you’re residing inside your means.

Story continues under this advert

Attempt to keep out of debt (Supply: Freepik)

2. Save and Make investments:

Put 20% of your paycheck right into a financial savings account or right into a SIP (Systematic Funding Plan); even when it’s a small quantity, begin the behavior of saving, in order that you should have one thing put apart for an emergency. Investing is a manner of rising your earned revenue whereas requiring you to be affected person and consider the long run.

3. Do Not Borrow:

Your first paycheck is prone to have a temptation related to it to purchase issues with a bank card or to get a mortgage. An anecdote that must be repeated: it’s uncommon to enter debt and have it work out nicely (aka so you may pay it again). Attempt to keep out of debt and sure haven’t any debt in any respect. Even when you need to service excellent obligations, attempt to ensure you repay any loans and all the time pay your bank card invoices in full each month.

Managing and constructing monetary administration will not be alleged to be punitive; it’s about creating stability and freedom. “Your first paycheck isn’t just one other paycheck; it may be your first step to lifelong monetary confidence,” reiterated Pandey.