Goldman Sachs is planning to ask junior analysts to confirm each three months that they do not have a job lined up elsewhere, in a periodic pledge of loyalty, Bloomberg stories.

The loyalty oaths are supposed to get forward of personal fairness companies, which may provide candidates jobs as much as two years earlier than a possible begin date. These companies have been extending affords to junior bankers at the beginning of their job coaching at Goldman Sachs, or earlier than they even start coaching, in a course of often known as on-cycle recruitment.

Associated: Right here Are the Odds of Touchdown a Summer season Internship at Goldman Sachs or JPMorgan

Goldman Sachs is not the one financial institution on Wall Avenue to crack down on poaching from personal fairness companies. Final month, JPMorgan Chase, the largest financial institution within the U.S. with $3.9 trillion in property, warned incoming analysts in a leaked e mail that they might be fired in the event that they accepted a future-dated job provide earlier than becoming a member of the financial institution or throughout the first 18 months of their employment.

JPMorgan stated that the coverage was meant to forestall any attainable conflicts of curiosity.

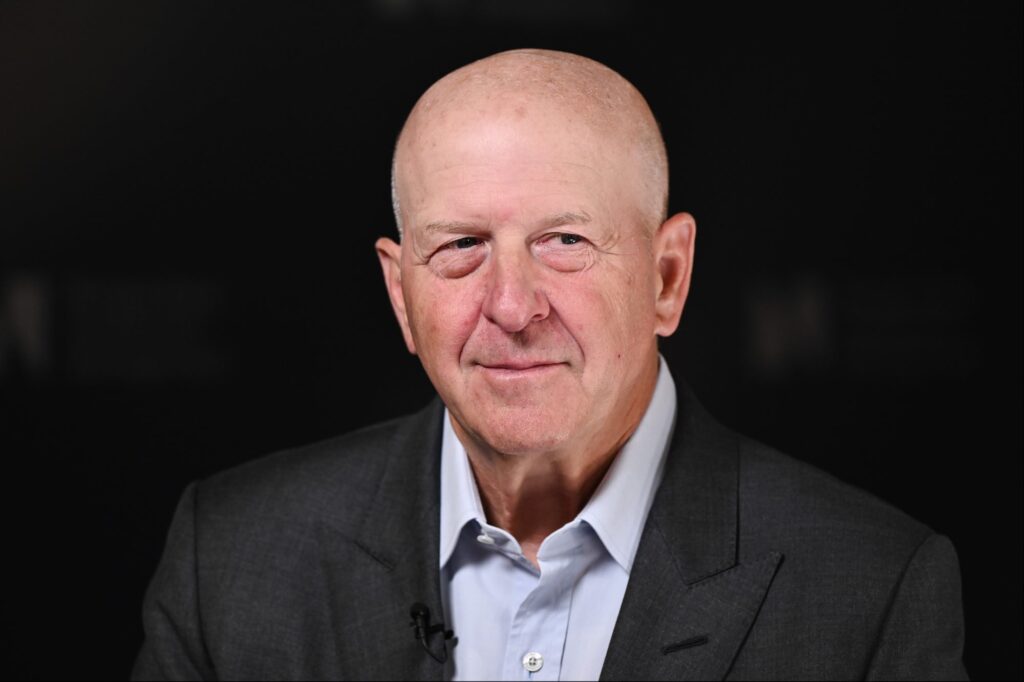

Goldman Sachs CEO David Solomon. Photographer: Naina Helén Jåma/Bloomberg by way of Getty Photos

JPMorgan CEO Jamie Dimon, 69, beforehand stated that the apply of shedding expertise to non-public fairness was “unethical.” At a chat at Georgetown College in September, Dimon stated that shifting to non-public fairness places JPMorgan “in a conflicted place” as a result of workers are already pledged to a different agency whereas they deal with confidential info at JPMorgan.

“I feel that is unethical,” Dimon stated on the speak. “I do not prefer it.”

Main personal fairness agency Apollo World Administration introduced final month that it will not conduct formal interviews or lengthen job affords to the category of 2027 in response to criticism concerning the personal fairness hiring course of starting too early.

Apollo CEO Marc Rowan instructed Bloomberg in an emailed assertion final month that “asking college students to make profession selections earlier than they honestly perceive their choices does not serve them or our trade.”

Apollo and Goldman Sachs provide comparable compensation packages. Based on federal filings pulled by Enterprise Insider, Apollo pays analysts a base wage of $115,000 to $150,000. Associates make anyplace from $125,000 to $200,000.

As compared, Goldman Sachs pays first-year analysts $110,000 and first-year associates $150,000. Second-year analysts make $125,000.

Goldman Sachs is planning to ask junior analysts to confirm each three months that they do not have a job lined up elsewhere, in a periodic pledge of loyalty, Bloomberg stories.

The loyalty oaths are supposed to get forward of personal fairness companies, which may provide candidates jobs as much as two years earlier than a possible begin date. These companies have been extending affords to junior bankers at the beginning of their job coaching at Goldman Sachs, or earlier than they even start coaching, in a course of often known as on-cycle recruitment.

Associated: Right here Are the Odds of Touchdown a Summer season Internship at Goldman Sachs or JPMorgan

The remainder of this text is locked.

Be part of Entrepreneur+ at this time for entry.