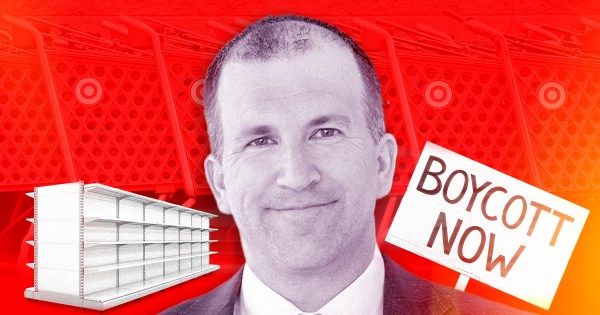

Goal’s incoming CEO, Michael Fiddelke, is going through an enormous drawback earlier than his first day on the job.

The longtime Goal exec will formally take over the reins from Brian Cornell in February. The retailer has reported 11 straight quarters of flat or falling gross sales and has seen boycotts from each side of the political spectrum over the previous two years. Goal has additionally struggled to inventory merchandise and preserve sturdy customer support in shops.

Over the previous yr, Goal’s inventory has fallen 62% whereas Walmart’s inventory has grown 20% and Amazon’s inventory is up 53%.

Analysts and retail consultants advised ADWEEK that the issues aren’t insurmountable—Goal nonetheless has nice places and powerful model fairness—however the points transcend the cultural flashpoints which have dominated information cycles. Advertising is a part of the issue, however Goal’s challenges embrace deep operational points that decide how folks store.

“They’ve misplaced their Goal-ness,” stated Steve Dennis, a former retail govt and president and founding father of SageBerry Consulting. “There was a transparent step up from Walmart and the off-price of us—that they had extra service, a friendlier place, and personal labels. It looks as if they’ve misplaced that.”

Throughout Goal’s earnings name on Aug. 20, Fiddelke outlined three of his speedy priorities: Rebuilding Goal’s merchandising technique, enhancing the in-store expertise, and investing in expertise.

Caught within the murky center

For years, Goal differentiated itself as a barely premium retailer identified for distinctive merchandise, together with well-liked personal labels like Cat & Jack, a line of youngsters’s attire, and meals model Good & Collect. The slogan “anticipate extra, pay much less” precisely articulated Goal’s place, Dennis stated.

“It was clear that that they had a price positioning and that you simply’re going to get extra,” he stated.

However post-Covid, the retail panorama is split between important objects and nonessential objects. Walmart and Amazon have centered on necessities like grocery and fundamentals, whereas retailers like T.J. Maxx and Sephora have invested closely into nonessential merchandise like style and sweetness—leaving Goal within the center with no clear differentiator, stated one retail promoting exec who spoke on the situation of anonymity on account of relationships with retailers.

Walmart particularly has been gaining steam by innovating with new platforms and differentiating itself in advertising campaigns.

“They’re getting attacked on the backside by retailers who’re higher at value,” the manager stated. “Goal is on this uncomfortable center as a result of they’re additionally not an reasonably priced luxurious to compete with Sephora and Coach.”

Goal is pulling again on a few of its partnerships with high-end manufacturers. For instance, Goal and Ulta Magnificence will finish a five-year deal this month that positioned Ulta outlets in Goal shops. Nevertheless, a brand new cope with Warby Parker is anticipated to arrange 5 pop-up shops within the second half of this yr, in line with Goal.

The result’s a slipping in-store expertise for patrons together with lengthy traces and lacking merchandise, stated Sucharita Kodali, retail trade analyst at Forrester.

“There may be not stock within the retailer—there might be empty cabinets the place paper towels are alleged to be,” Kodali stated. “One of many important causes that individuals go to Goal is to get staples like paper towels. After they don’t have that, that utterly deters folks.”

Brad Jashinsky, director analyst at Gartner, stated that enhancing in-stock objects and conserving shops clear might be troublesome for Goal.

“This sounds easy however requires a cautious coordination between native, regional, and company staffing, together with merchandising and operations,” Jashinsky stated. “Staffing ranges want to enhance, coaching packages ought to be expanded, and each group must be measured to make sure these issues don’t proceed.”

Fiddelke acknowledged the issues with the in-store expertise when talking on Goal’s current earnings name. He stated that Goal’s on-shelf availability metrics throughout the second quarter, “have been the perfect we’ve seen in years.”

“We will by no means take as a right the love our friends present us once they affectionately consult with their native retailer as ‘my’ Goal,” he stated. “That’s loyalty we have to persistently exit and earn—from well-stocked cabinets and clear shops to a pleasant and useful group and a web based expertise that brings inspiration and discovery, we need to delight our friends who store with us each time they store. As I’ve made clear, we have now to do higher right here, particularly within the consistency of our expertise.”

A drop in modern advertising

Goal has lengthy collaborated with style designers and types to create distinctive traces of merchandise utilizing a playbook that builds up hype earlier than the gathering drops on Goal’s web site. However with extra purchasing occurring on platforms like TikTok, Goal is lacking out on utilizing TikTok to promote the merchandise, stated the retail promoting exec.

“They’ve an outdated Rolodex with these collabs—it appears like two firms who usually are not at their greatest hoping that they will save one another,” they stated.

Nonetheless, these partnerships seem like paying off for Goal. In April, Goal partnered with Kate Spade to promote 300 attire, accent, and residential merchandise, leading to “the strongest” partnership that Goal has had in a decade, outgoing CEO Cornell stated on the current earnings name.

Altering how Goal handles design partnerships and product launches is considered one of Fiddelke’s priorities, he advised traders throughout the earnings name. He stated Goal is growing an effort known as Enjoyable 101 to revamp its hardlines merchandise, which embrace issues like electronics, home equipment, and toys.

“To reestablish our management right here, we have to transcend the occasional design partnership or new product launch and guarantee we’re bringing this authority throughout every class in our enterprise all year long,” he stated. “That can require change, and that change is occurring.”

Goal has additionally confronted backlash for its dealing with of range, fairness, and inclusion points. In 2023, Goal eliminated some Delight Month merchandise. And in January, Goal ended some DEI packages that supported Black-owned companies, leading to a grassroots boycott.

Forrester’s Kodali known as the boycott “an enormous cultural challenge at Goal,” including that some traders wished Goal to rent a CEO from outdoors the corporate to resolve for these kind of cultural points. Incoming CEO Fiddelke is a 22-year veteran of Goal.

“Lots of people suppose that there must be a totally cleansing of home to start out over once more,” Kodali stated.